Strength of the Economy Is Surprising the Experts

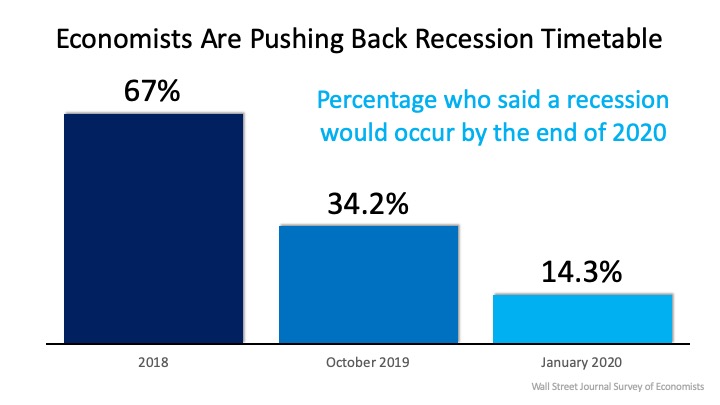

We’re currently in the longest economic recovery in U.S. history. The strength of the economy is even surprising experts. That has caused some to ask these experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by the Wall Street Journal (WSJ) for the Economic Forecasting Survey predicted we would have a recession no later than the end of this year (2020). The same study done just three months ago showed more than one third of the economists still saw an economic slowdown right around the corner.

The news caused concern among consumers. This is evidenced by a recent survey done by realtor.com that shows 53% of home purchasers (first-time and repeat buyers) currently in the market believe a recession will occur by the end of this year.

Wait! It seems the experts are changing their minds….

Now, in an article earlier this month, the Wall Street Journal (WSJ) revealed only 14.3% of those economists now believe we’re in danger of a recession occurring this year (see graph below): The WSJ article strongly stated,

The WSJ article strongly stated,

“The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election with a healthy labor market backing it up, economists say.”

This optimism regarding the economy was repeated by others as well.

CNBC, quoting Goldman Sachs economists:

“Just months after almost everyone on Wall Street worried that a recession was just around the corner, Goldman Sachs said a downturn is unlikely over the next several years. In fact, the firm’s economists stopped just short of saying that the U.S. economy is recession-proof.”

“When Barron’s gathers some of Wall Street’s best minds—as we do every January for our annual Roundtable—we expect some consensus, some disagreement…But the 10 veteran investors and economists who convened in New York on Jan. 6 at the Barron’s offices agree that there’s almost no chance of a recession this year.”

“The U.S. economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats mostly eliminated the risk of a recession.”

Robert A. Dye, Chief Economist at Comerica Bank:

“I expect that the U.S. economy will avoid a recession in 2020.”

These national prediction have consequences for the state of Michigan as well. Researchers don’t expect Michigan’s economy to turn in 2020, but due to the state’s dependence on manufacturing, the growth in Michigan might not meet the national average.

Michigan economic growth, which is measured as state-level gross domestic product (gross state product), will likely trail the nation at 2.3% growth in 2020. Following a projected growth of 2.9% in 2019 Michigan’s GDP will be the lowest it has been since 2015.

Despite some economic growth, predictions are that state employment growth will remain flat to negative in 2020. Weakness in Michigan’s manufacturing sectors is tempering the growth projections as both durable and non-durable goods manufacturing is expected to lose jobs in 2020, even as jobs are being added in places like Detroit.

Gains in jobs will come from professional and businesses services and education and health services which are expected to offset most of these manufacturing job losses. The job sector shuffle will potentially add to unemployment projections, with Michigan’s overall unemployment rate bumped up to around 4.5%, up from 4.1% in 2018.

With less friction in local labor markets, Michigan’s wage and salary growth is not expected to keep pace with the nation. With that, total wage and salary growth should be up about 2.3% at the close of 2019 and up by 1.6% in 2020. Adding other sources of income, total personal income is projected to be up by 2.3% in 2020, or just under the rate of inflation

Bottom Line

There probably won’t be a recession this year. The strength of the economy has not been diminished and that’s good news for you, whether you’re looking to buy or sell a home.